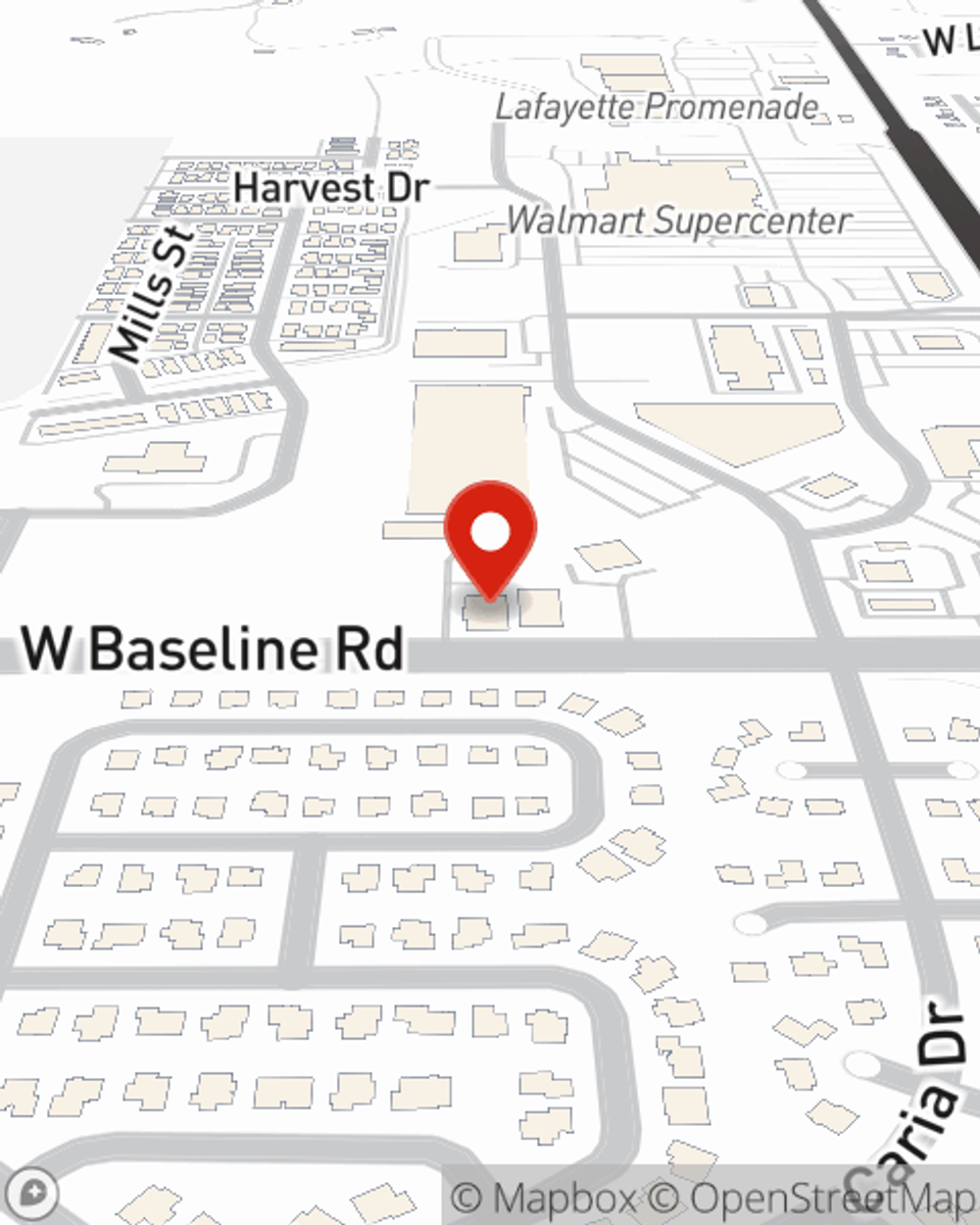

Business Insurance in and around Lafayette

Get your Lafayette business covered, right here!

No funny business here

- Lafayette, CO

- Louisville, CO

- Erie, CO

- Broomfield, CO

- Superior, CO

- Northglenn, CO

- Boulder, CO

- Federal Heights, CO

- Thornton, CO

- Boulder County, CO

- Adams County, CO

- Longmont, CO

- Arvada, CO

- Brighton, CO

- Commerce City, CO

- Weld County, CO

- Broomfield County CO

- Colorado, US

- Denver, CO

- Lakewood, CO

- Frederick, CO

- Westminster, CO

- Golden, CO

- Loveland, CO

This Coverage Is Worth It.

Preparation is key for when something unavoidable happens on your business's property like an employee getting injured.

Get your Lafayette business covered, right here!

No funny business here

Small Business Insurance You Can Count On

With options like business continuity plans, extra liability, a surety or fidelity bond, and more, having quality insurance can help you and your small business be prepared. State Farm agent Jim Plane is here to help you customize your policy and can assist you in submitting a claim when the unexpected does arise.

Do what's right for your business, your employees, and your customers by visiting State Farm agent Jim Plane today to research your business insurance options!

Simple Insights®

ATV safety tips

ATV safety tips

Taking the proper ATV safety steps can help keep you and your family safe while you enjoy your riding experience.

Small business types

Small business types

What is a sole proprietorship, an LLC and other small business types — and which one is best for you?

Jim Plane

State Farm® Insurance AgentSimple Insights®

ATV safety tips

ATV safety tips

Taking the proper ATV safety steps can help keep you and your family safe while you enjoy your riding experience.

Small business types

Small business types

What is a sole proprietorship, an LLC and other small business types — and which one is best for you?